An emergency fund refers to a small amount of money kept specifically for the case of sudden or unpredicted expenses, which may include repairing your car, paying the hospital bills or loss of income. An emergency fund will prevent you from borrowing money, reduce your stress levels, and make you better able to cope with life’s challenges.

But how much money should you put in your emergency fund? And how can you save it without giving up your other financial goals?

In essence, it depends on how you are situated but a common guideline is to have at least 3 to 6 months of living expenses in your emergency fund. By this you mean paying for all those essential expenses like rent, food, utilities, transport and healthcare.

Despite this, saving that much money can be difficult, particularly when starting with nothing or having a small income. That’s why this simple, yet practical savings plan can help you save $1000 towards emergency fund in six months.

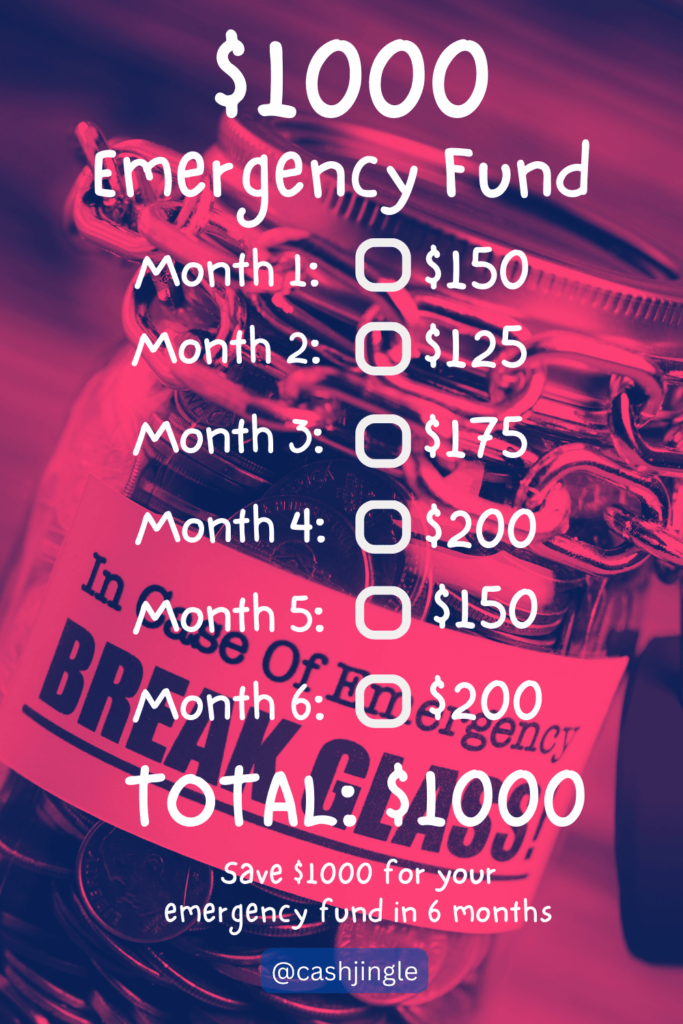

The $1000 Emergency Fund Savings Plan.

The concept behind this plan is to save a different amount of money each month, ranging from $125 to $200. . Doing so allows you to align your savings rate with your current level of earnings and expenditure, and avoid feeling stressed out.

Here is the breakdown of the savings plan:

- Month 1: $150

- Month 2: $125

- Month 3: $175

- Month 4: $200

- Month 5: $150

- Month 6: $200

- TOTAL: $1000

The plan begins with $150 per month and then drops to $125 in the next month, which is the lowest amount of money. This means that you may incur the costs of setting up an emergency fund, for example, when opening a new savings account or purchasing a piggy bank.

The saving amount is subsequently increased into $175 on the third month, $200 on the fourth month. This is to capitalize on the momentum and drive that will be generated as your emergency fund grows.

Of course, you could customize the plan to fit your own personal tastes. For instance, your monthly income could be greater or lesser than your expenditure, and therefore you will make savings of this amount every month. Alternatively, you can also save this amount every month which, in case you find it easier, you have an option of tracking and managing.

All you need is to be dedicated to the plan and save a given amount every month without fail. Here are some tips and tricks to make saving easier and fun for you.

Storing your emergency fund.

Having an emergency fund is not the whole story; save your money for your emergency funding. The other half of the cake is setting aside your emergency fund in a safe but easily accessible location where it earns some interest until you need it.

Here are some options for storing your emergency fund:

1) Savings Account

2) Money Market accounts

3) High-yield savings account

4) Certificate of deposit (CD)

Learn how to to store your emergency fund in detail

Download free Emergency fund printable

Free Printable 1

Download your $1,000 Emergency Fund Free Printable

Free Printable 2

Download your $1,000 Emergency Fund Free Printable

Free Printable 3

Download your $1,000 Emergency Fund Free Printable